Construction started on the 2nd ground mounted plant owned by the Maiora Renewables Fund 2

Marking a milestone threshold, construction has officially begun on the second ground mounted plant owned by the Maiora Renewables Fund 2, establishing a new stage of progress.

Maiora Haijing inked a six-year NT$1.888 billion syndicated loan agreement with 3 banks

Maiora Haijing Energy Co., Ltd. inked a six-year NT$1.888 billion syndicated loan agreement with Bank SinoPac, EnTie Commercial Bank, and CTBC Bank on 6 November, marking a new milestone for Taiwan’s development in renewable energy. For more information please refer to: https://udn.com/news/story/7314/7561852

永堯太陽能電廠正式啟用,彰化大城鄉綠能躍進

美歐亞綠能股份有限公司开发的位於臺灣彰化縣大城鄉的永堯能源股份有限公司一期太陽能電廠於2023年6月20日正式啟用。详情请见新闻报道:https://udn.com/news/story/7314/7282787

MRE's First Ground-mounted Project in Taiwan Now Operating

MRE's first ground-mounted project in Taiwan has reached a significant milestone as it is now officially connected to the grid and operating.

MRE started the construction of its first ground mounted project in Taiwan.

MRE started the construction of its first ground-mounted project in Taiwan.

MRE shared its PV project experience at the Changhua Green Energy Forum 2022

On 24 March 2022, MRE shared its PV project experience with the industry, government, and academicians at the Changhua Green Energy Forum held by the Changhua County government, which aimed to help local enterprises to prepare for their energy transition and sustainable development.

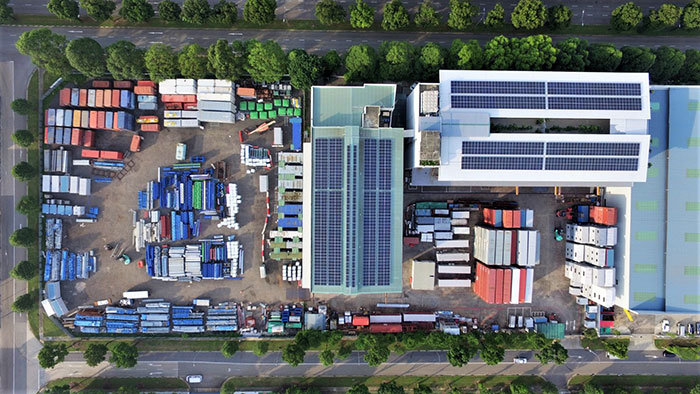

MRE achieved turn-on for a 1200kWp PV system in Singapore

In December 2021, MRE has successfully achieved turn-on for a 1200kWp PV system for one of Singapore’s largest packaging providers. The PV system will supply nearly half of the facility operation’s electricity needs with affordable and sustainable solar power.

MRE had a successful town hall meeting

MRE had a successful town hall meeting on 7 December 2021. This picture shows the group of staff who attended the town hall meeting in the MRE Taiwan office in person.

MRE has broken ground on a new 1,200kWp PV project in Singapore

In April 2021, MRE has broken ground on a new 1,200kWp PV project in Singapore which will provide sustainable power to one of the biggest packaging solution providers in Singapore.

MRE has commissioned its latest solar 451kWp PV project in Singapore

In January 2021, MRE has commissioned its latest solar 451kWp PV project in Singapore on the facility rooftop of a leading architectural glass processor in the Tuas area of Singapore.

Singapore Project VII

Maiora’s latest client is a dynamic, one-stop glass processor that customizes architectural glass products through high-tech processes. They have grown to a significant player in the glass processing industry since the company’s establishment in 2002. Recognizing the significant energy consumption of their company activites, they have made the proactive decision to install a solar PV system on their facility rooftop. The solar PV system helps to decrease the power grid electricity consumption by over 30%.

| System Size | 451kWp Solar PV System |

| No. of PV Modules | 1,002 Trina Solar Tallmax Mono 450Wp |

| No. of Inverters | 4x Huawei SUN2000-100KTL |

| Annual Energy Yield | 577,300kWh per annum |

| Estimated CO2 Saving | 237 Metric Tonnes per annum |

Singapore Project VI

Maiora is proud to welcome a Singapore metal materials supplier into our continuously growing list of Singapore clients. The client is a renowned manufacturer of high-quality steel and non-steel building solutions, providing a comprehensive range of products and turnkey solutions. They are affiliated with established and reputed companies such as Germany’s, Kalzip GmbH and Fischer Profil GmbH, and Taiwan’s Yieh Phui Enterprise. A huge number of 1,360 solar panels will help to make the clients facility a net generating facility which will export excess solar energy to the power grid.

| System Size | 350kWp Solar PV System |

| No. of PV Modules | 876 Trina Solar Tallmax Mono 400Wp |

| No. of Inverters | 3x Huawei SUN2000-100KTL |

| Annual Energy Yield | 448,000kWh per annum |

| Estimated CO2 Saving | 184 Metric Tonnes per annum |

Singapore Project V

We are excited to introduce a new client to our list of Singapore clients. The client is an established player and striving to be a market leader in industrial Timber production, providing customized fabrication of wood packaging and logistics solutions. Recognizing that wood is at the centre of their company activities, they take a keen interest in working with strategic partners towards preserving the natural habitat for the generations to come. A huge number of 1,360 solar panels help to make the clients facility a net generating facility which exports excess solar energy to the power grid.

| System Size | 369kWp Solar PV System |

| No. of PV Modules | 900 Trina Solar Tallmax Mono 410Wp |

| No. of Inverters | 4x Huawei SUN2000-60KTL/100KTL |

| Annual Energy Yield | 472,000kWh per annum |

| Estimated CO2 Saving | 194 Metric Tonnes per annum |

Clay Kinney

Director

Clay is a Founding Partner of MAIORA and a member of the Investment Committee. He focuses primarily on renewables and financings. In our first fund, he headed up MAIORA`s Japan entity, focusing primarily on Japan Solar and Mezzanine financing opportunities. Prior to MAIORA, Clay was the Head of Structured Finance at Deutsche Bank in Tokyo. He has as over 20 years of financial industry experience, spanning debt financing, equity issuance, M&A, and complex tax structuring, working for global financial institutions including Goldman Sachs, UBS, and PricewaterhouseCoopers. Clay sits on the Board of Directors for the Enex Infrastructure Investment Corp (9286.T)

David Payne

Chief Financial Officer

David is the CFO of Maiora Renewables Energy. David has over 25 years of investment banking experience to MD level, having previously worked at UBS, Merrill Lynch, Citi and Deutsche Bank. David spent much of his investment banking career in management and COO roles for Markets businesses in London, Hong Kong and Japan and was recently Head of Business Control and Surveillance. David holds an MA in Economics and is a qualified chartered accountant. David worked at PWC prior to his investment banking career.